You won’t want to miss these hottest TaxAct Black Friday & Cyber Monday 2026 deals! Right below, you’ll find exclusive coupon codes, short descriptions, and easy-to-use buttons to grab up to 45% off on TaxAct plans making it easier and more affordable to file your taxes this year.

TaxAct Basic Plan – Up to 20% Off

File simple federal returns with ease. Great for first-time filers.

👉 Best for straightforward tax situations.

TaxAct Deluxe Plan – Up to 45% Off

Maximize deductions with itemized credits, mortgage interest, and donations.

👉 Ideal for homeowners and detailed filers.

TaxAct Premier Plan – Up to 45% Off

Advanced tools for investments, dividends, and rental property income.

👉 Perfect for investors and landlords.

TaxAct Self-Employed Plan – Up to 20% Off

Comprehensive tools for freelancers, contractors, and business owners.

👉 Best for small business and gig workers.

Early Bird Offer – Up to 30% Off

Grab your discount before the peak tax season rush.

👉 Perfect for planners who file early.

All Plans Sitewide – Up to 35% Off

Works on any TaxAct plan during Black Friday.

👉 Simple choice if unsure which plan to pick.

🎁 Recently Added TaxAct Black Friday & Cyber Monday Offers

| Deal Name | Description | Coupon Code | Discount |

|---|---|---|---|

| TaxAct Basic Plan Saver | File simple federal returns at a discounted rate for new and existing users. | TAXBASIC25 | Save 20% Instantly |

| TaxAct Deluxe Max Deductions | Unlock tools for itemized deductions, mortgage interest, and more. | TAXDELUXE25 | Flat 20% Off |

| TaxAct Premier Investment Pack | Advanced filing for investments, dividends, and rental income. | TAXPREMIER25 | 20% Off for New Users |

| TaxAct Self-Employed Pro | Full package for freelancers, gig workers, and small business owners. | TAXSELF25 | Save $15 on Plan |

| TaxAct Federal + State Bundle | Get both federal and state filing in one discounted package. | TAXBUNDLE25 | 20% Off Bundle |

| TaxAct E-File Express | Secure, fast electronic filing for quicker refunds. | TAXEFILE25 | Flat 20% Off |

| TaxAct State Filing Special | Discounted rate for single-state or multi-state filing. | TAXSTATE25 | 20% Off Sitewide |

🛒 How to Apply TaxAct Black Friday Coupon Code (Step-by-Step)

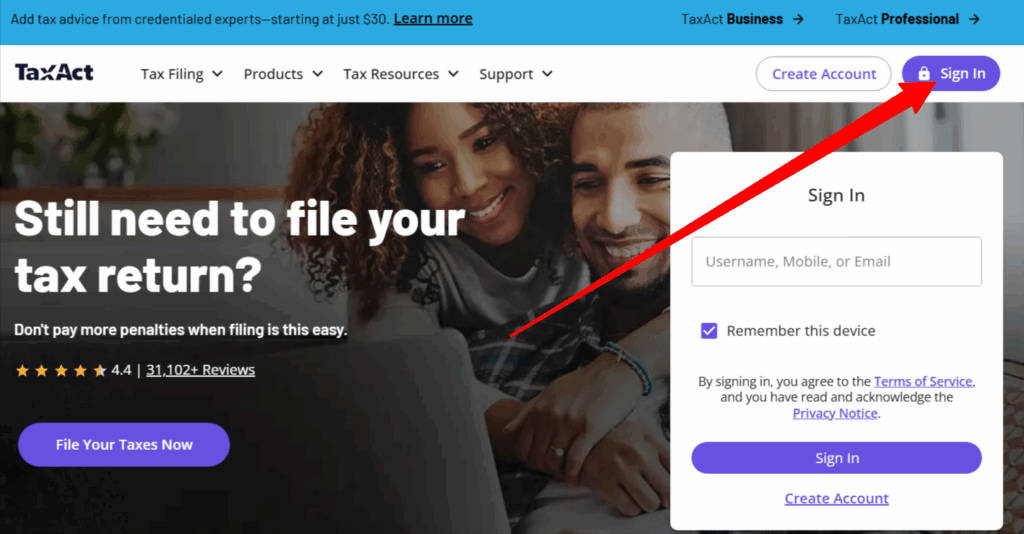

Step 1 – Visit the official TaxAct Black Friday offer page

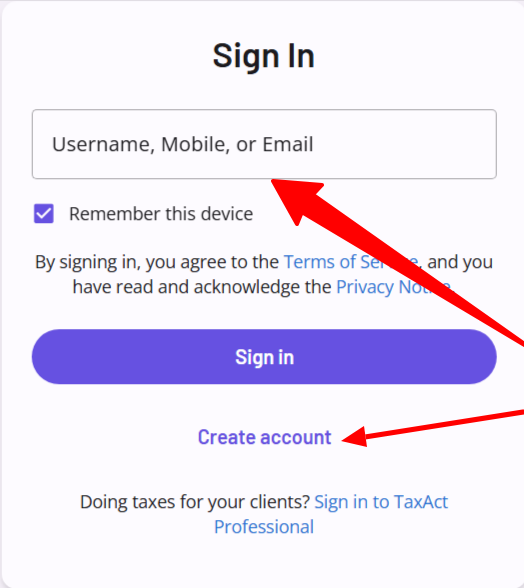

Step 2 – Login and SignUp Your Account

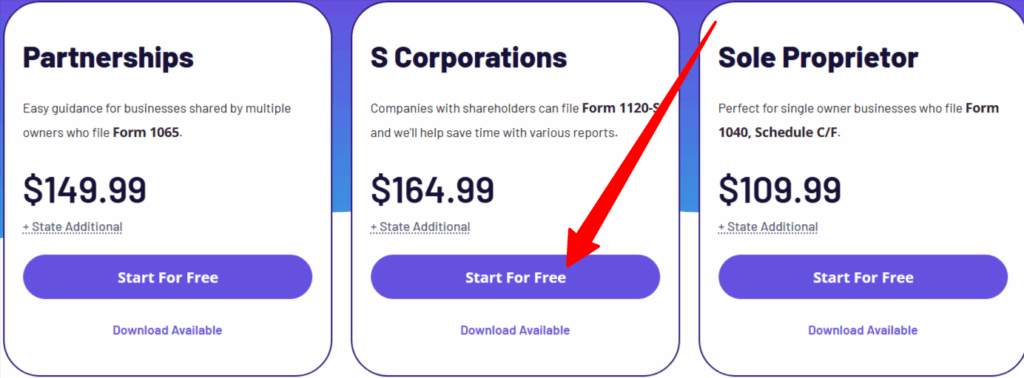

Step 3 – Choose the plan that suits your needs

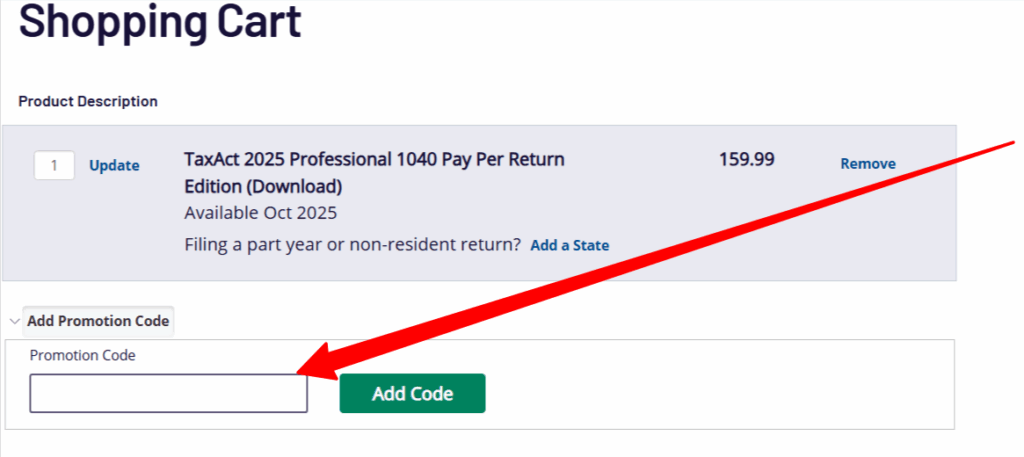

Step 3 – Enter the coupon code at checkout (if required)

Step 4 – Complete your payment and enjoy the discount

TaxAct Business Plans

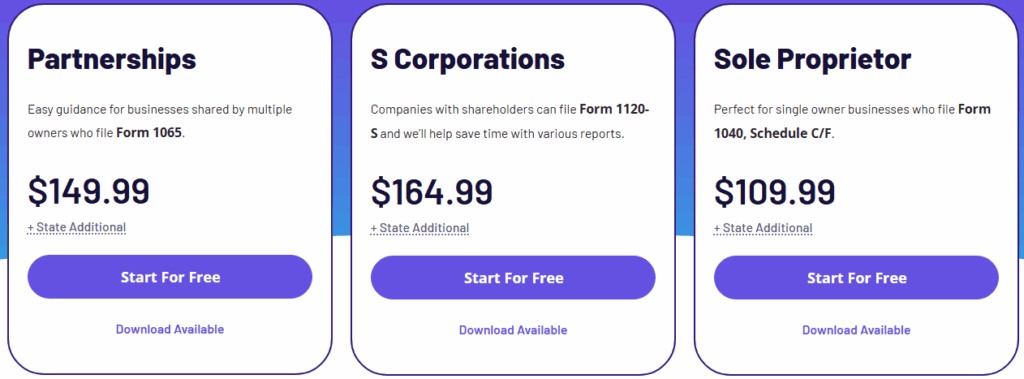

Partnerships

Easy guidance for businesses shared by multiple owners who file Form 1065.

💲 $149.99 (+ State Additional)

Start for free and pay only when you file.

Download option available.

S Corporations

For companies with shareholders filing Form 1120-S, with tools to save time through automated reports.

💲 $164.99 (+ State Additional)

Start for free and pay only when you file.

Download option available.

Sole Proprietor

Perfect for single-owner businesses filing Form 1040, Schedule C/F.

💲 $109.99 (+ State Additional)

Start for free and pay only when you file.

Download option available.

Key Features of TaxAct

1. Step-by-Step Guided Filing

Easy walkthroughs for federal and state returns with plain language prompts.

2. Multiple Filing Options

Supports Individuals, Self-Employed, Partnerships, S Corporations, C Corporations, and Trusts.

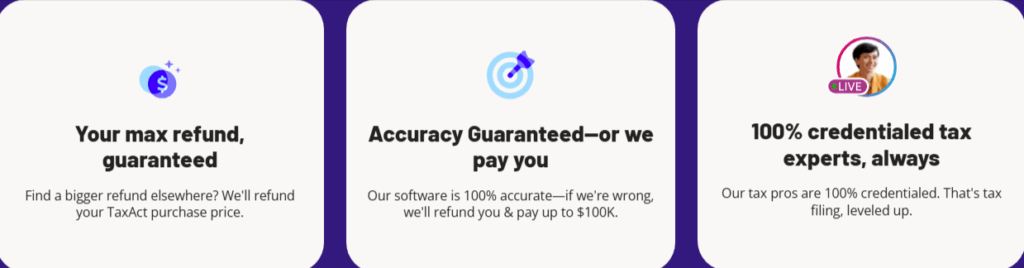

3. Max Refund Guarantee

Ensures you get the maximum refund allowed or the lowest tax liability.

4. Deduction Maximizer

Helps identify credits and deductions you might miss (mortgage interest, donations, education credits, etc.).

5. Import Previous Returns

Quickly bring in data from last year’s TaxAct or even from other tax software.

6. Free E-File with Every Plan

File electronically at no extra cost to speed up refunds.

7. Secure Data Encryption

Bank-level encryption and multi-factor authentication for your tax data.

8. Real-Time Error Checking

Alerts you instantly if something doesn’t match IRS guidelines.

How Much Will You Save by Using TaxAct Black Friday & Cyber Monday Offer?

If you’ve ever dreaded tax season because of the cost of software, this Black Friday is your chance to change that. TaxAct is offering up to 20% off across its most popular tax filing plans. That means more money in your pocket and less stress when it’s time to file.

Whether you’re a self-employed freelancer, a small business owner, or just someone looking to maximize deductions, TaxAct’s discount applies to plans that make tax prep easy and affordable.

The best part? The savings aren’t just on the basic plans you can get the same great tools and support at a much lower price. Plus, if you buy now, you can use the software for the upcoming tax year without worrying about future price hikes.

So if you want a fast, simple, and budget-friendly tax filing experience, this Black Friday deal is worth grabbing before it’s gone.

Think Before Using Any Black Friday Offer

Black Friday deals can be tempting, but you should always double-check before buying. Make sure the discount is valid for the plan you actually need some offers may only apply to higher-tier packages.

Always purchase directly from the official TaxAct website to avoid fake or expired coupon scams. Third-party websites may list outdated codes that won’t work at checkout.

Don’t wait until the last day to claim your deal. Black Friday offers are time-sensitive and can expire without warning.

Lastly, read the terms and refund policy. If your tax filing needs change, you’ll want to know if you can upgrade or switch plans without losing your discount.

“Give Thanks & Save Big: TaxAct Black Friday 2026– File Smarter for Less”

This topic blends the Thanksgiving spirit of gratitude with the excitement of Black Friday deals.

You can frame it around how customers can “be thankful” for extra savings and stress-free tax filing before the busy new year.

Example Intro Angle:

“As we gather around the Thanksgiving table, it’s the perfect time to think ahead not just about turkey and pumpkin pie, but also about getting your taxes sorted for less. This TaxAct Black Friday & Cyber Monday 2026 deal lets you lock in up to 45% off on tax filing plans, so you can head into the new year with peace of mind and a little extra cash in your pocket.”

Final Thoughts

If you’ve been searching for a reliable and affordable way to file your taxes, TaxAct Black Friday & Cyber Monday 2026 is the perfect time to lock in big savings. With up to 45% off on plans for individuals, freelancers, and businesses, you’ll get all the tools you need to file accurately and on time without overpaying.

Whether you’re a first-time filer or a seasoned business owner, TaxAct’s step-by-step guidance, secure platform, and refund-maximizing features make it a smart choice. But remember, these discounts won’t last forever grab your deal now and make your next tax season stress-free.

“READ MORE”

NordVPN Black Friday & Cyber Monday: Upto 76% Off 2025

CallRail Black Friday & Cyber Monday: Save Upto 75% OFF

❓ FAQs

When does the TaxAct Black Friday sale start?

The sale usually begins in late November, a few days before Black Friday, and runs through Cyber Monday.

Do I need a coupon code to get the discount?

Some offers are applied automatically at checkout, while others require a coupon code. Always check the deal details before purchasing.

Can I use the Black Friday discount for state tax filing?

Yes, most deals apply to both federal and state filing, but the exact discount may vary depending on the plan.

Is the Black Friday deal available for existing customers?

Yes, both new and existing TaxAct users can take advantage of Black Friday and Cyber Monday offers.

What happens if I miss the Black Friday deal?

If you miss the sale, you’ll have to purchase at the regular price. The next big discount period is usually during early tax season promotions.